tax benefit rule state tax refund

State tax refunds are only SOMETIMES taxable on the 1040. Myrna and Geoffrey filed a joint tax return in 2020.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The tax benefit rule is a feature of the United States tax system.

. If you receive a refund of all or part of a deduction you claimed for example a state tax refund you must report as income the amount of tax benefit you had received from the amount of the refund. The rule says that you cannot receive two benefits for any particular item. Your state tax refund will be taxable if you used it as a deduction in the year before.

There are other kinds of recovery items but the most common is a state tax refund. A state tax refund is taxable income if you received a tax benefit by deducting your state income taxes on a previous tax return. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense resulted in a tax benefit.

In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the. However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction taken for the refunded amount reduced tax in the earlier year. In applying the AMT nonrefundable credits tax benefit rule to state income tax refunds the program assumes that if there was any tax benefit received in 20XX by deducting the entire amount of state income taxes refunded then the full amount of the refund after accounting for other adjustments is taxable.

In year 2 your income is increased such that you eventually get taxed and the gimmick fails. For example if I itemized my deductions in 2002 and I deducted my state taxes as I am allowed I received a benefit. 111 partially codifies the tax benefit rule which generally requires a taxpayer to include in gross income recovered amounts that the taxpayer deducted in a prior taxable year to the extent those amounts reduced the taxpayers tax liability in the prior year.

Ad File 1040ez Free today for a faster refund. This is the result of something called the tax benefit rule. The most common situation would be that you deducted your state and local income taxes on your 2018 return and then received a state tax refund during the calendar year 2019.

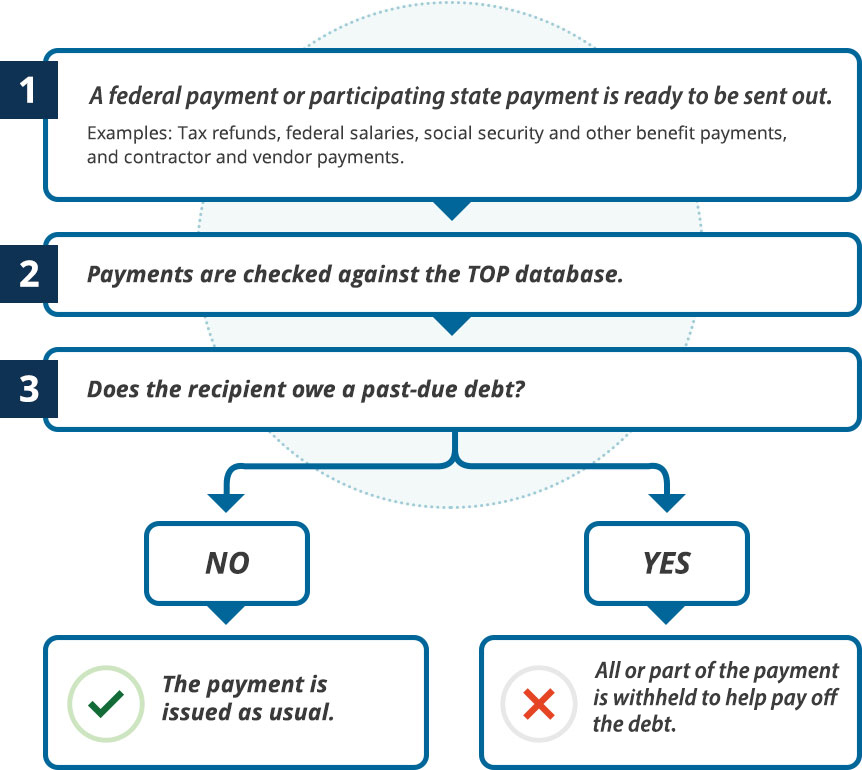

Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2020. Whether state refunds are includable on a federal return depends on the tax benefit rule. The rule says if a refund can be linked to a prior deduction which the taxpayer actually benefitted from then the refund is taxable to the extent of that benefit.

2019-11 issued on March 29 the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on deductions of state and local taxes to determine the portion of any state or local tax refund that must be included in income on the taxpayers federal income tax return. Basically the rule are set such that you cant game the system by taking a big deduction on state taxes overpaid in year 1 and then get the money refunded to you in year 2. The entire amount recovered in the current year had given the taxpayer a tax benefit.

As the Tax Court explained under the tax benefit rule as it applies to state income tax refunds for a taxpayer to be able to exclude a state income tax refund payment from income the refund payment must be for an overpayment of tax for which the taxpayer did not take a federal tax deduction when it was paid in a preceding year. Its main principle is that if a taxpayer recovers a sum of money that should have been paid in the past they must pay tax upon it if it was not counted in their taxable earnings in a previous year. If an amount is zero enter 0.

Once the fraud occurs youre. Tax benefit rule state tax refund Wednesday March 2 2022 Edit. Simply stated the refunds recoveries are taxable only to the extent the taxpayer received a tax benefit from the deductionthat is the deduction must have reduced taxes or.

Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2021. If a state or local income tax refund is received during the tax year the refund must generally be included in income if the taxpayer deducted the tax in an earlier year. Tax Benefit Rule Of 111 Should Shield State Tax Refunds For Taxpayers Over The Salt Limit Current Federal Tax Developments Lime.

If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income. The most common example is a state income tax refund of tax deducted in the prior year. Copyright 2008 HR Block.

Their AGI was 85000 and itemized deductions were 25100 which included 7000 in state income tax and no other state or local taxes. Myrna and Geoffrey filed a joint tax return in 2019. When the couple paid the excess refund 400 to the state in the prior year it increased their itemized deduction on their federal return to 14000 from 13600.

A state income tax refund is a recovery item whose taxability on your federal return is governed by the tax benefit rule of Internal Revenue Code section 111. If an amount is zero enter 0. One common source that is frequently overlooked by tax advisors and more often misunderstood is the application of the tax benefit rule IRC section 111 to state and local tax refunds.

Get your tax refund up to 5 days early. WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. Their AGI was 92325 and itemized deductions were 27400 which included 6850 in state income tax and no other state or local taxes.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Do State And Local Sales Taxes Work Tax Policy Center

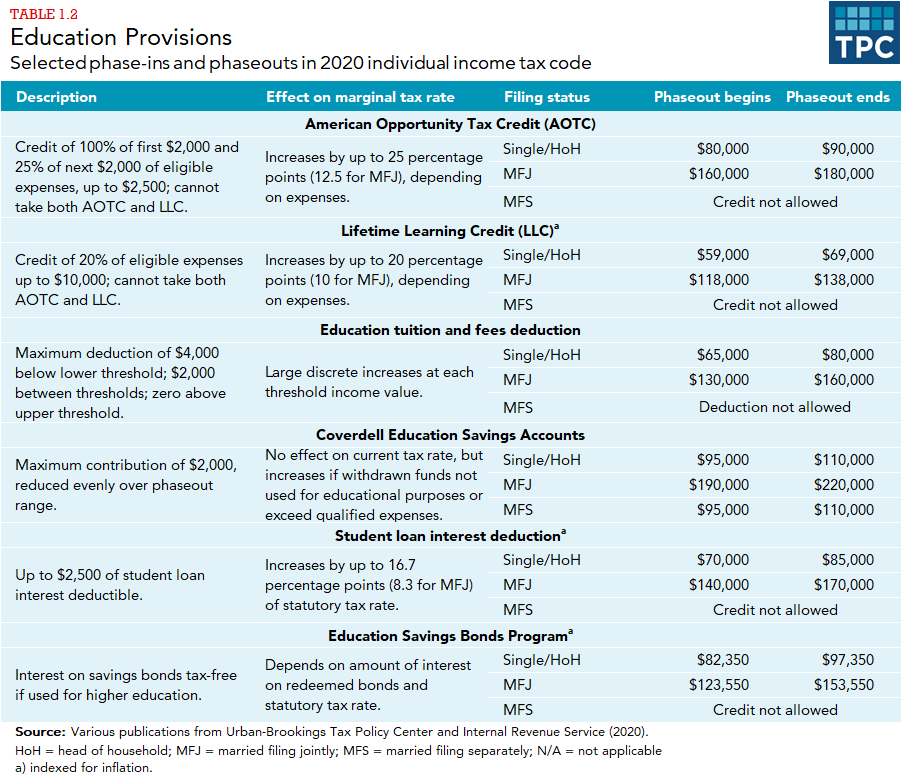

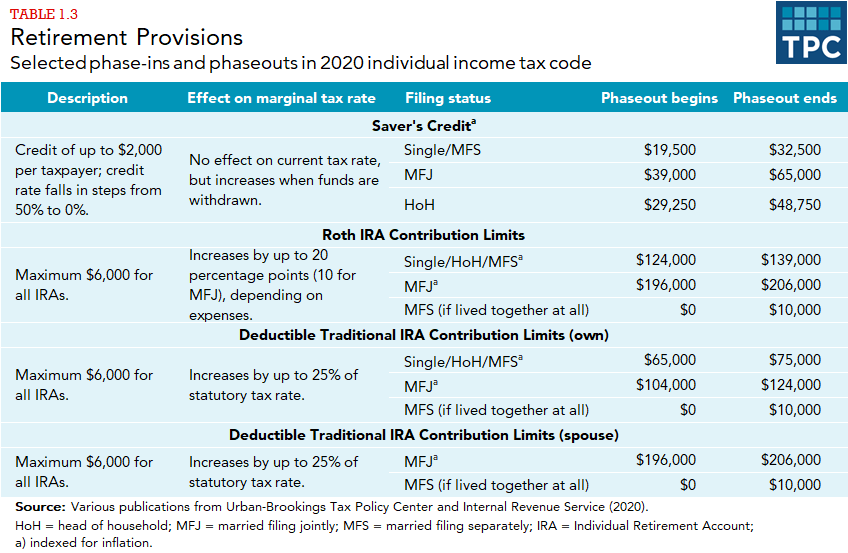

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

6 Benefits Of Filing Income Tax Return

How The Tcja Tax Law Affects Your Personal Finances

How The Tcja Tax Law Affects Your Personal Finances

What Are Marriage Penalties And Bonuses Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How Does The Deduction For State And Local Taxes Work Tax Policy Center

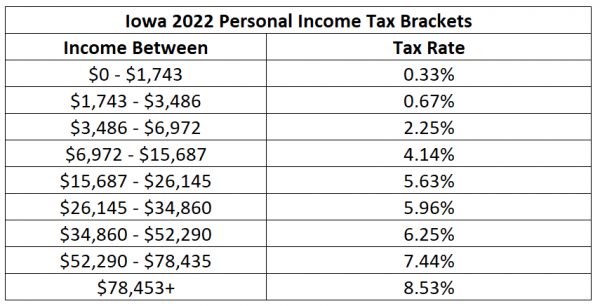

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax